Mike Forsyth began his banking career as a teller at West One Bank (later acquired by U.S. Bank) in the mid-1990s. Today, the industry looks vastly different, and he believes his old job might soon become obsolete.

Yet, amidst the digital revolution, Forsyth sees a future where branches persist. “My personal belief is the branch is never going away,” he said. “We will change how we envision and utilize them, but they will remain a key component to the overall banking experience.”

Now at the forefront of reimagining the future of banking environments, those early days working as a teller still inform his perspective. These experiences have culminated in his current role as the Director of Transformation Strategy at DBSI, a leading design-build firm known for its innovative approach to elevating retail banking experiences.

At DBSI, Forsyth leverages his extensive background to drive strategic initiatives that redefine how banks engage with their customers. He’s been at the firm for a dozen years, the last six in his current position.

“I've transformed myself from a teller into a financial institution transformationalist. It’s an interesting combination because I understand what the front lines go through in the branch environment, but also the desires that the executive team have.”

A featured speaker at the upcoming BankSpaces retreat (May 5-7 in Palm Springs), we sat down with Mike to get his take on what branch transformation means in his eyes, what banking leaders can learn from other industries, and what branches will look like in a decade from now.

“Transformation” is a word that’s thrown around a lot. How can a refreshed or newly built branch truly offer a “transformational” experience?

Forsyth: The concept of transformation can vary significantly based on the context and objectives being looked at. At DBSI, our approach to transformation involves a thorough understanding of an institution's current state, including any obstacles or challenges they face. We also focus on their desired future state and the goals they aim to achieve. This perspective allows us to identify the essential questions that need answering, tailoring our strategy to each client's unique needs.

I think successful transformation hinges on three key elements:

- Physical Space: The design and layout of the physical environment.

- Technology: The integration and use of technological solutions.

- People and Process: The involvement and development of staff and the optimization of various processes.

In our experience, institutions attempting transformation often concentrate on the physical space and technology, neglecting the 'People and Process' component. This oversight can lead to suboptimal outcomes, as just relocating staff into a new environment without adequate preparation or process adjustments rarely leads to success. Instead, a holistic approach that equally prioritizes physical space, technology, and people/processes is essential for a comprehensive and effective transformation.

Understanding what happens within the confines of an institution and how it impacts client experiences is paramount. Elevating that experience demands a focused effort across all three areas I mentioned.

Can you give me a few examples of companies outside financial services that have done innovative things to accentuate the customer experience and what bank leaders can learn from their work?

Forsyth: Chick-fil-A is a prime example that comes to mind, and not just because of my location in the South. A relentless focus on customer experience and a commitment to continuous improvement drives their approach to the market. They are a QSR, but their innovative strategies, especially in optimizing the drive-through experience, really stand out. They have implemented multiple lanes to enhance service efficiency, but their efforts extend far beyond merely increasing physical capacity.

Chick-fil-A has equipped its staff with technology, like tablets, to proactively meet customers where they are rather than adopting a passive, reactive stance. This initiative reflects their deep investment in creating a robust and customer-centric culture. Training is a cornerstone of their philosophy.

I remember an excellent quote from their founder (S. Truett Cathy). During an interview, when questioned about the risk of investing heavily in training employees who might eventually leave, he offered a perspective that resonated with me: The greater risk lies in not training employees and having them stay. This approach highlights the importance of enhancing the staff experience as a means to improve the customer experience.

Chick-fil-A is a visionary organization that integrates those three key elements I talked about – a well-designed physical space, advanced technology, and highly trained associates. This combination ensures they deliver an exceptional experience that customers expect.

What might the bank branch of 2034 look like?

Forsyth: I don't have a crystal ball, but based on my observations, I see significant changes in the design of future bank branches. A key shift will involve moving away from traditional transactional areas, such as teller stations, which I anticipate will be phased out through the strategic use of technology. This evolution will pave the way for a move towards what I refer to as a 'Universal Staff' model. This concept involves employing associates who, with technological support, can manage both simple transactions and more complex advisory roles.

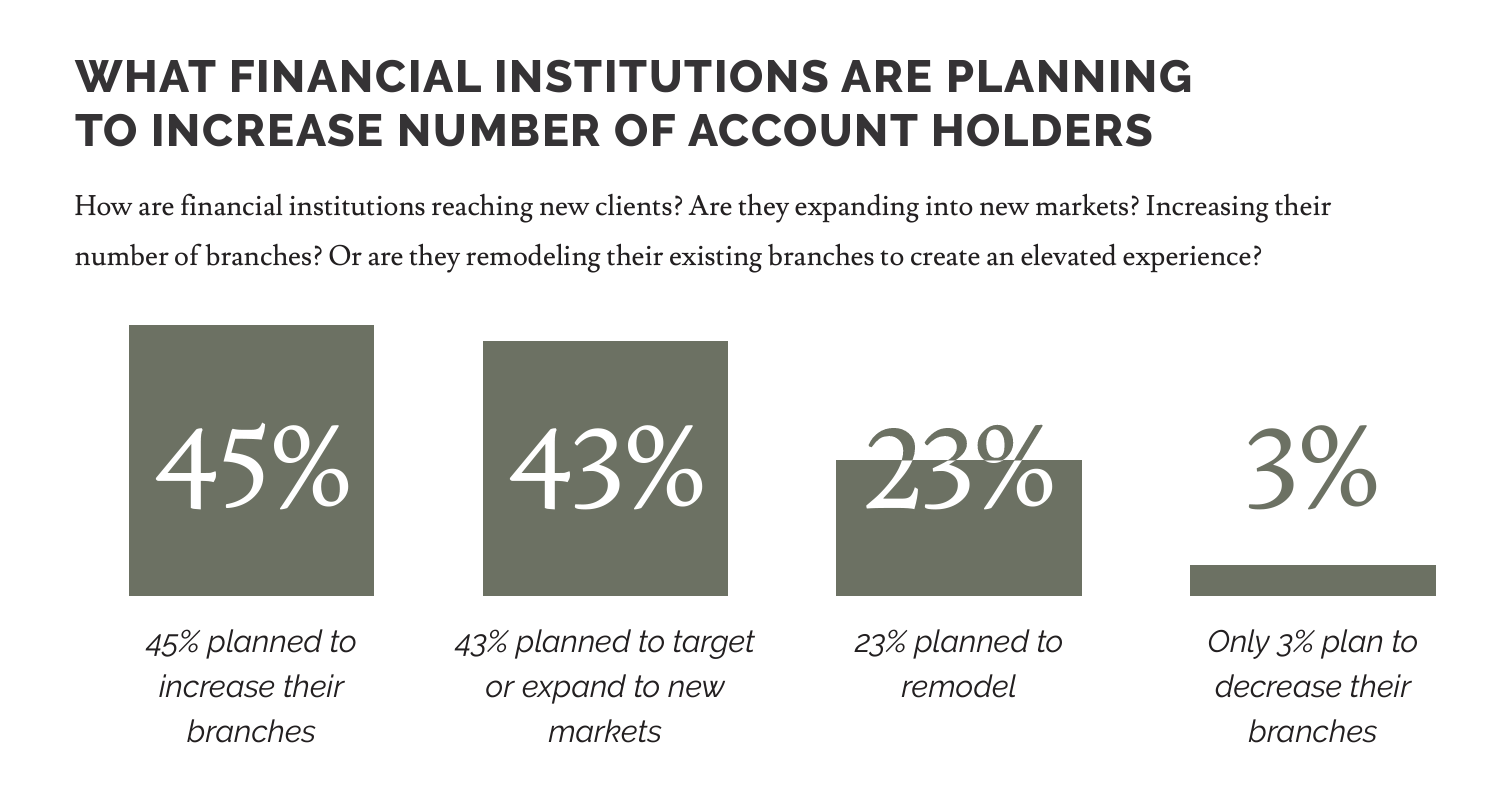

At DBSI, our approach is grounded in rigorous market analysis rather than speculative guesses. We recently published a study titled 'Inside the Boardroom Report,' which sheds light on current trends within the banking sector. The findings are telling: 45% of institutions are planning to expand their branch networks, 43% aim to enter new markets, and 23% intend to renovate their existing facilities. Only 3% of those surveyed indicated plans to reduce the number of branches.

These insights lead us to believe that while branches are here to stay, their function and design will undergo significant transformation. Branches in the future are likely to be smaller and more agile, leveraging technology to enhance capability without the need for huge spaces.

DBSI’s “Ideation Center” is “where transformation becomes reality.” Can you give me some big ideas that have come out of this experimental hub?

Forsyth: The Ideation Center, which we call “The Banker's Playground," is a dynamic space where financial services executives are invited to explore and envision future possibilities for their institutions. A key focus of the center is to demonstrate how the integration of thoughtful design, cutting-edge technology, and the expertise of trained bank associates can significantly enhance customer experiences. This includes achieving faster service, greater efficiency, and the ability to accomplish more with less.

Among the innovations showcased at the Ideation Center, is our exclusive micro-branch concept called "JunXion." This concept represents a significant evolution in branch design, offering the full capabilities of a traditional branch but in a fraction of the space—approximately one-tenth of the size.

Micro-branches are not only about 33% cheaper to construct but also offer a substantial reduction in total operating costs by as much as 61%. Additionally, the timeline for creating and launching a micro-branch ranges from six to 12 months, much less than the 18 to 36 months typically required for new traditional builds. This difference represents significant savings in both time and investment. That’s crucial for institutions looking to adapt quickly.

Another advantage of the micro-branch is its flexibility. These branches can be relocated as needed, allowing financial institutions to adapt to changing community dynamics without being fixed to one location. This mobility ensures that if a particular area does not yield the expected results, the branch can be moved to a more promising location, thereby safeguarding the institution's investment.

A significant innovation we advocate for is granting Branch Associates comprehensive access to cash, irrespective of their location within the branch—be it an office, the platform area, or the traditional teller line. This modern approach eliminates the need for conventional cash-handling methods, offering a solution that's accessible and implementable in today's branch networks. This advancement facilitates smoother operations and enhances service delivery across various branch settings.

We envision the branch of the future as a space featuring varied seating and meeting locations. This flexibility allows every transaction and client engagement to be conducted efficiently by a single associate. The essence of enhancing the client experience lies in the strength of the relationship between the client and a specialist or “Universal Associate.” Focusing on this relationship and leveraging technology can create a more responsive, efficient, and personalized banking environment.

What are bank design leaders missing? Where are their blind spots, and what do they need to do differently to create approachable and intentional spaces?

Forsyth: Starbucks stands out for its remarkable consistency in branding worldwide. Despite varying footprints and designs, Starbucks maintains a uniform experience through consistent branding, visuals, tailored local experiences, and even scents. Financial institutions often find this level of consistency challenging, especially when expanding through mergers and acquisitions, leading to a collection of branches that may not align with their brand identity.

The key challenge for these institutions is creating a cohesive brand experience across all locations, regardless of whether growth is organic or through acquisitions. Achieving this does not necessarily require a hefty investment. For instance, in DBSI’s recently released annual digital signage benchmark report, financial institutions implementing digital signage reported an average sales increase of 11% to 30%, with some even experiencing over 50% growth. That’s the power of effectively communicating brand messaging and services, which can be accomplished cost-effectively.

When working with financial institutions, we focus on understanding their unique value proposition and goals, ensuring they are reflected in their physical spaces. This approach reinforces their brand promise and enhances customer engagement. Despite the digital age, the physical branch continues to play a crucial role, serving as a visible presence in the community. It signifies a bank’s readiness to engage with customers, offering a space for discussing more complex transactions or services. The physical branch is kind of like a billboard for the organization, emphasizing the importance of a local presence and the ability to provide comprehensive services and support.

The transition from the exterior's curb appeal to the interior experience is critical, underscoring the need for vibrant, welcoming branches that convey the institution's brand promise and value proposition to every visitor.

Posted by

Branching into Tomorrow – Together.

Exploring the Future of Bank Branch Design + Technology

April 19-21, 2026 | Bonita Springs, FL

-Dec-04-2025-03-32-25-8096-PM.png)

-1.png)

Comments